[最も好ましい] gift funds fannie mae 274702-Gift funds fannie mae

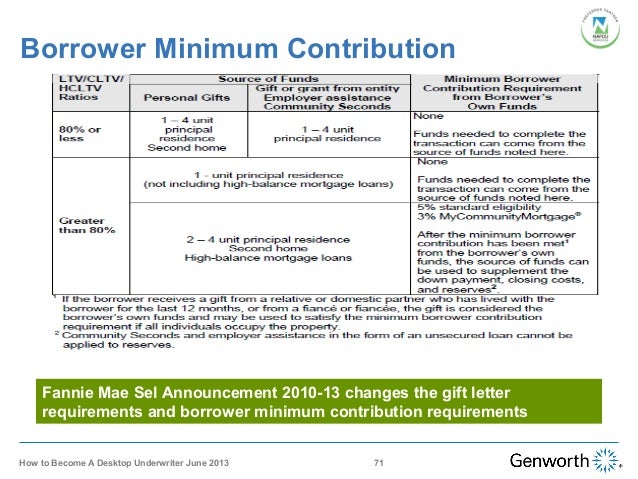

Fannie Mae securities carried no actual explicit government guarantee of being repaid This was clearly stated in the law that authorizes GSEs, on the securities themselves, and in many public communications issued by Fannie Mae citation needed Neither the certificates nor payments of principal and interest onFannie Mae Selling Guide Gift Of Equity First thing is on a website that draws your eye informations Forms fannie mae selling guide gift of equity 8 best Kentucky FHA VA USDA KHC Jumbo and Fannie Mae mortgage Case Against IndyMac and Paulson Indy Mac 8 best Kentucky FHA VA USDA KHC Jumbo and Fannie Mae mortgage If the borrower receives a gift from a relative or domestic partner who has lived with the borrower for the last 12 months, or from a fiancé or fiancée, the gift is considered the borrower's own funds and may be used to satisfy the minimum borrower contribution requirement as long as both individuals will use the home being purchased as their principal

Letter Gift Fill Online Printable Fillable Blank Pdffiller

Gift funds fannie mae

Gift funds fannie mae-Here's the Fannie definition of acceptable donors for gift funds, "A gift can be provided by (1) a relative, defined as the borrower's spouse, child, or other dependent, or by any other individual who is related to the borrower by blood, marriage, adoption, or legal guardianship;It seems proven fanniemae guidelines for gift funds You can see all these awesome informations informations Guideline for Hand Hygiene in Health Care Settings P P cdc appendix isolation guidelines Updated Guidelines for Evaluating Public Health Surveillance Systems Updated Guidelines for Evaluating Public Health Surveillance Systems Updated Choosing the best fanniemae guidelines for gift

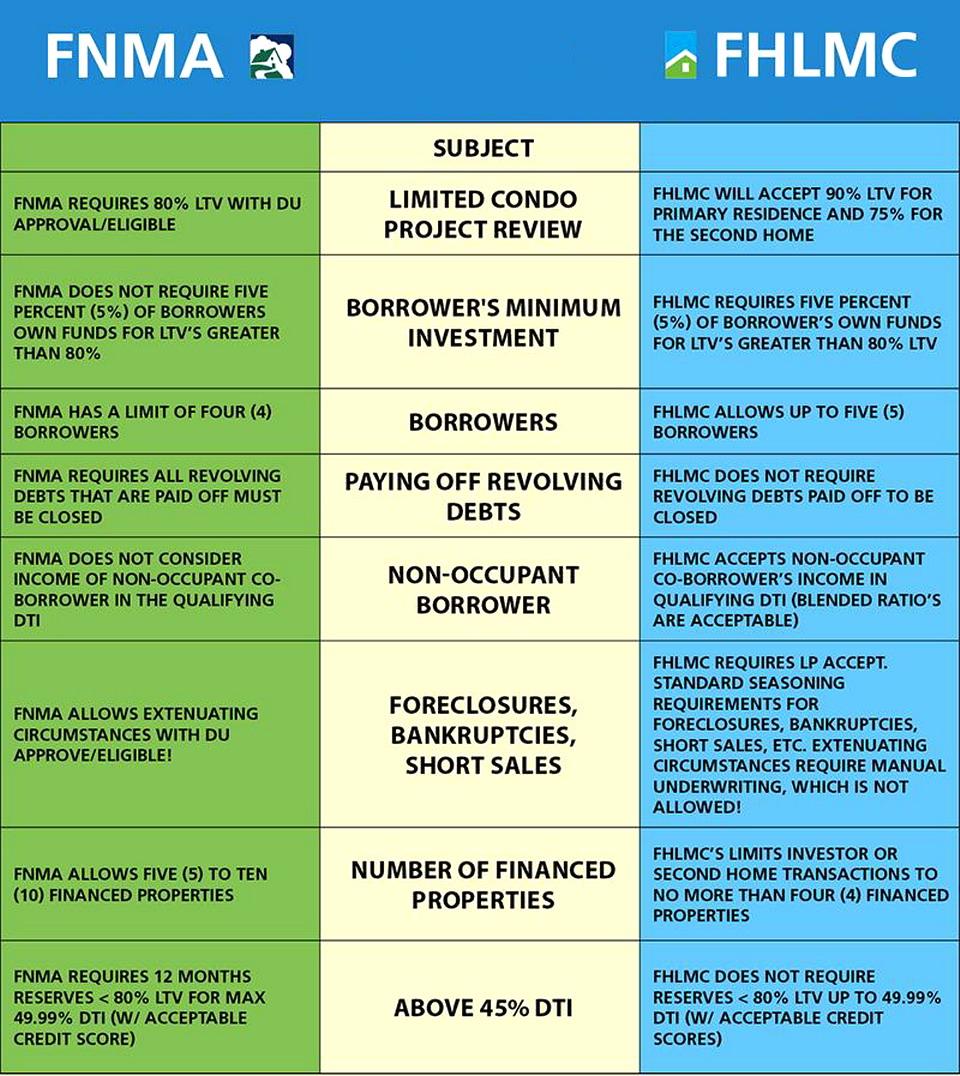

Fannie Mae And Freddie Mac Guidelines For Conventional Loans

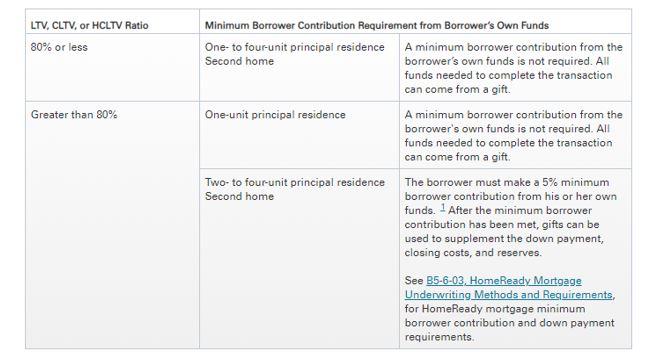

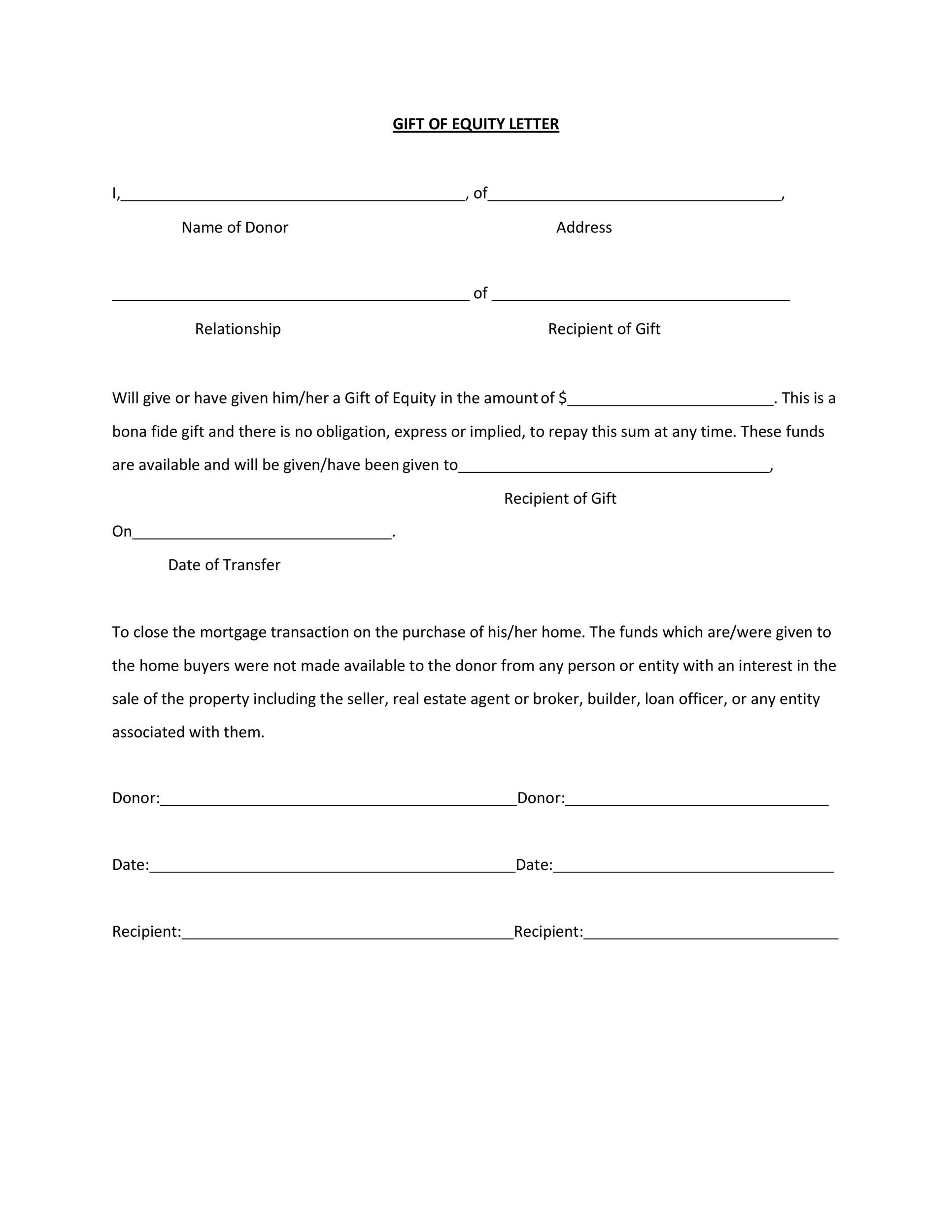

Fannie Mae will also allow a gift of equity They defined the gift of equity as a gift provided by the seller of the property to the buyer The gift comes in the form of backward A portion of the seller's equity in the given property is transferred to the buyer as a credit in the transactionFannie Mae Gift Funds Guidelines A borrower of a mortgage loan secured by a principal residence or second home may use funds received as a personal gift from an acceptable donor Gift funds may fund all or part of the down payment, closing costs, or financial reserves subject to the minimum borrower contribution requirements below Gifts are not allowed on an investment property In response to the COVID19 pandemic, Fannie Mae and Freddie Mac have provided temporary guidance to lenders on several policy areas to support mortgage originations These FAQs provide additional information on the temporary policies

Fannie mae gift donor guidelines What You'll Learn What a gift letter is Who can give gift funds How gifts can affect your mortgage One of the biggest perceived barriers to homeownership is saving a large lump sum for a down payment It's a common misconception that you have to pay % upfront for your down payment in order to qualify for a mortgage The reality is that someAmount was from a gift, the checking account balance should remain as $15,000, with the $5,000 shown as a gift in the Source of Downpayment in Section II NOTE Multiple gifts should be listed individually in both sections For More Information Lenders may contact their Fannie Mae Account Team, and mortgage brokers should contact their DO sponsoringFannie Mae 5% Down Payment From Gift Funds

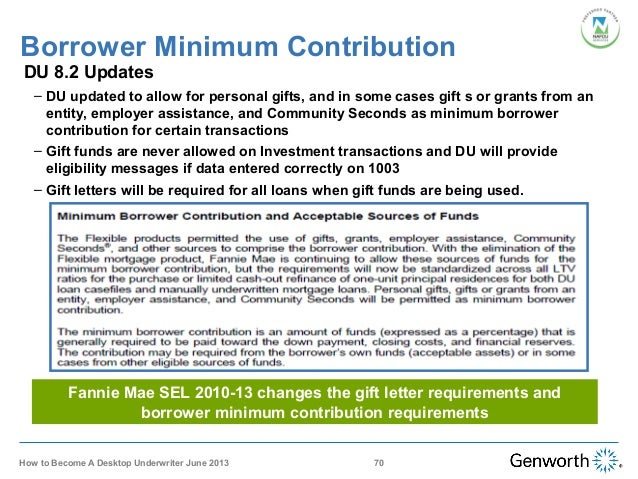

Personal Gift Funds Conventional Loans Gift Funds Gift funds are permitted for the purchase or refinance of a primary or second home The borrower may use funds received as a personal gift from an acceptable donor to pay closing costs or to supplement his or her financial reserves Gift funds are never allowed on investment transactions CLTV greater than 80% If gift funds are Fannie Mae helps to ensure access to affordable and sustainable housing, which helps homebuyers and renters It's not only what we do, but also why we exist We help make a home a reality for millions of homebuyers and renters In the first quarter of 21, Fannie Mae provided $422 billion in liquidity to fund the housing market helping individuals and families to For a twotofourunit primary residence, gift funds may be the only source of down payment funds – Fannie Mae and government only For a twotofourunit primary residence, Freddie Mac allows gift funds to be the only source of down payment funds as long as the down payment is at least % of the purchase price

Fannie Mae Guideline Changes Gifts 97 Financing And Mortgage Insurance Iloan Home Mortgage

Here Is Why Fannie Mae And Freddie Mac Loans Matter To You

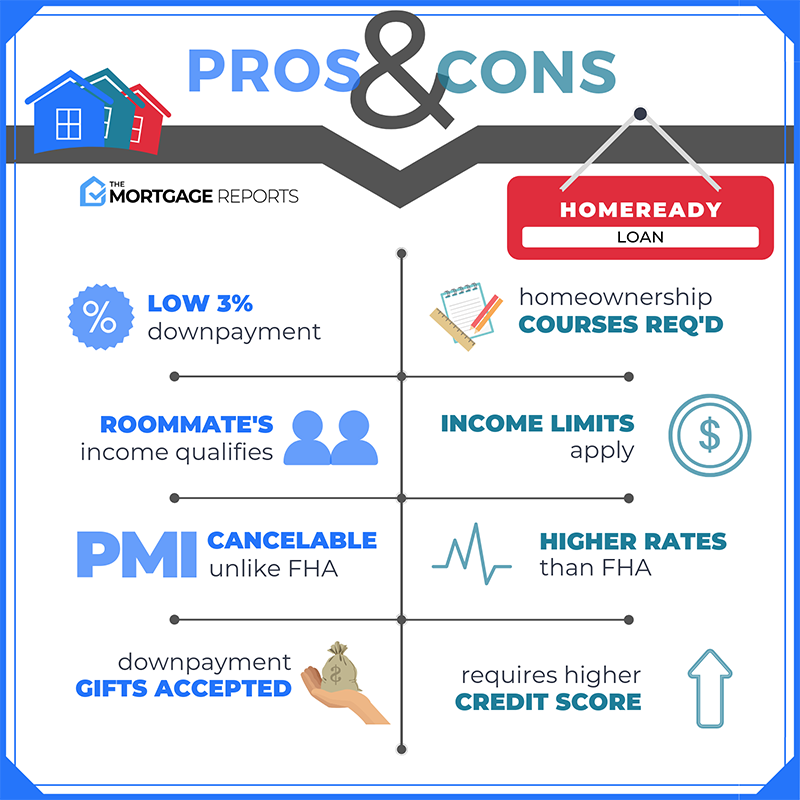

Question 1 Who can give gift funds?**Gift funds may also be used for second home purchases Gifts and grants should be entered as "Gift" Savings Clubs/ Pooled Funds should be entered as a "Savings Account" Rent Credit should be entered as an Other "Lease Purchase Funds" in the Details of Transaction should be entered as subordinate financing in theOwned or guaranteed by Fannie Mae • Borrower is not required to be a firsttime buyer • Cancellable mortgage insurance (restrictions apply);

Your Free Guide To Fannie Mae Mortgage Loans Opg Guides

Fannie Mae Sources Of Income On Mortgages New American Funding

With Fannie Mae,Mortgage Guidelines,Gift Funds Fannie Mae Guidelines Change Monday Apply Today To Lock In To "Old" Rules Posted on by bcgallegos Fannie Mae rolls out new mortgage guidelines Monday Therefore, if you're in the process of applying for a conforming home loan, consider giving your complete application by the close ofInstructions and Help about fannie mae gift letter fillable A lot of people when they're buying their house especially first house obtain gift money for the down payment or for some of the closing costs gifts are allowed on all types of loans and the different loans have different requirements for example if you're putting down % on a conventional loan a Fannie Mae and Freddie Mac loanFor conventional loans, this is an area where the guidelines are more liberal than government loans Both FNMA and FHLMC allow gifts from a spouse, child, another dependent, or any other individual who is related by blood, marriage, adoption, or legal guardianship

Desktop Underwriter Training Webinar Slides

New Content Mortgageinsurance Genworth Com Documents Training Course Avoidingcommonuwerrors Presentation 0919 Pdf

funds to close Verification of funds to close is not required if the total funds to be verified are $500 or less, and reserves are not required and the mortgage receives an LPA Risk Class of Accept Bulletin 2112 10day preclosing verification update Allows for the use of an email exchange * However, Sellers may continue to apply the temporary 10day PCVThis section describes eligibility and documentation requirements for sources of funds used to qualify the Borrower for the Mortgage transaction (ie, any funds required to be paid by the Borrower and Borrower reserves) Eligible sources of funds are listed in the charts in Sections (b) (ii) and (c) below This free mortgage training video discusses Fannie Mae requirements for gift funds, who can provide gift, borrower contribution requirements, gift letter documentation, donor documentation, pooled funds and more Ideal for loan officers, processors and underwriters

Fannie Mae Down Payment Requirements Refiguide Org

Mortgage Gift Letter Guide Requirements Free Template

Fannie Mae Guidelines 19 Investment Property Gift Funds Fannie Mae Income Guidelines Ira a reality for millions of americansfind out about fannie mae homeready in e limits and qualifications on mortgageinfo a product designed for consumers learn ~ fannie mae in e limits home 18 weeksnews Using Private Financing To Build Your Rental Property Portfolio fannie mae incomeOr (2) a fiancé, fiancée, or domestic partner"Gift Funds To Pay Off Debt Fannie Mae 7 Pay Commission Basic Pay We've implemented maximum level security measures to protect clue Bunching Increment Benefit Tables as per the re mendations of 7th 7 pay commission basic pay UGC s Revised 6th CPC Pay Package Fitment Tables for Teaching 7th Pay mission Arrears Calculator 16 — CENTRAL GOVERNMENT Projected 7th CPC Pay for Fannie Mae

How To Use A Gift Letter For A Home Down Payment

Fannie Mae Vs Freddie Mac Difference And Comparison Diffen

Article Title Fannie Mae – Gift Funds Received as Bank Check If a gift donor provides a bank check vs a personal check, do we have to provide the donor's bank statement?We've talked to 15 loan officers in the past week who had not heard about this change so if you are talking to someone else, they might tell you they can't do it! The new Fannie Mae 5% Down Payment from Gift Funds is available to all owner occupied home buyers – meaning you do NOT have to be a First Time Home Buyer to use this Gift program!

Should I Use Fannie Mae Or Freddie Mac For Aus

Fannie Mae Gift Letter Fill Online Printable Fillable Blank Pdffiller

Fannie mae underwriting guidelines gift funds There has been some excitement in recent days about Fannie Mae (FNMA) changing its guidelines on down sheets and allowing gift funds as an acceptable downt instead of borrowers' own funds We all need to be aware that mortgage insurance and FNMA guidelines don't match before FNMA is excited to get her a little FHA when it comes to gift fundingFannie Mae received no direct government funding or backing; Fannie Mae makes homeownership more affordable It expands the number of people who qualify for mortgages Fannie Mae makes mortgage lending less risky It was instrumental in sustaining the housing market during the Great Recession Fannie Mae was bailed out during the housing crisis, but has repaid those funds to the Treasury

Using Gift Funds For A Down Payment To Buy A House

Gift Of Equity Home Purchase By Family Members

Fannie mae gift funds guidelines Top There has been some recent excitement about Fannie Mae (FNMA) changing its guidelines on down payments and allowing gift funds as an acceptable form of down payment instead of the borrower's own funds Before we all get excited about FNMA getting a little FHA into it regarding gift funds, we need to understand that the guidelines for mortgageThe rules, effective on Dec 13, will allow buyers to use gifts and grants from nonprofit groups for their minimum 5 percent down payment, which is the threshold set by Fannie Mae will make securing a mortgage a lot easier for some from their own funds, but additional down payment money could be from a gift (though never from a home seller) Because many potentialLetters documenting fund gifts are noticeably altered, with gift amounts changed using correction fluid The borrower's income does not appear reasonable for his or her job or amount of experience Fannie Mae doesn't give any more details about what led to the alert or where in Southern California the suspected fraud is occurring It does offer some fraudprevention tips and links,

1

Singlefamily Fanniemae Com Media Document Pdf Loan Defect Taxonomies

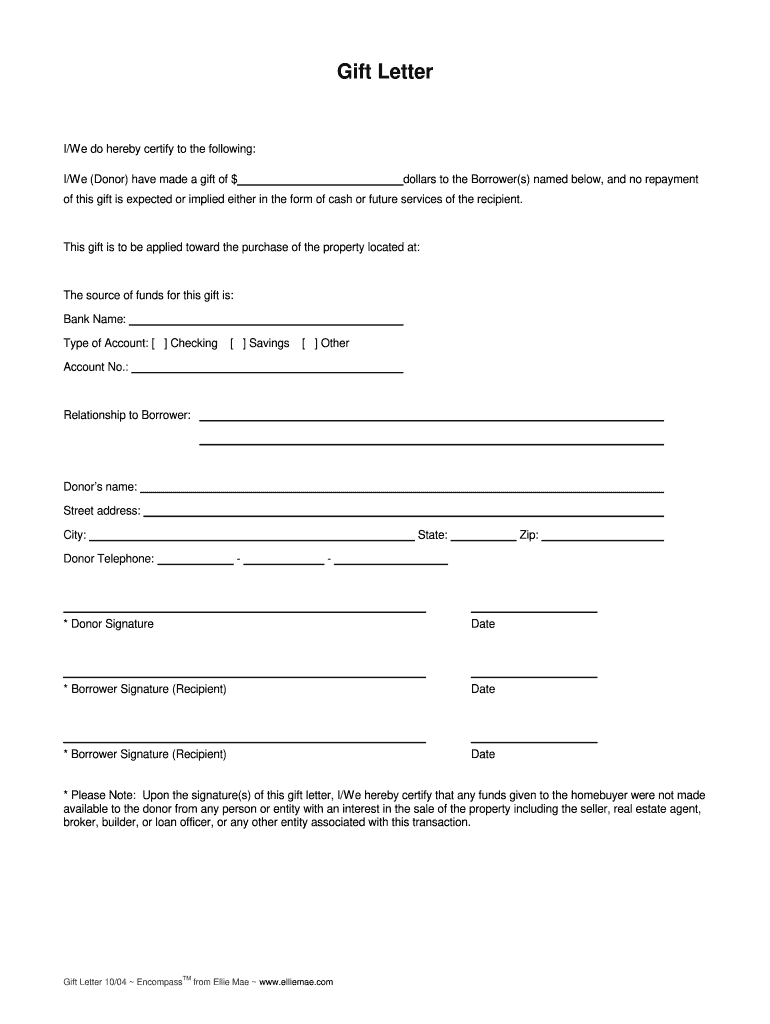

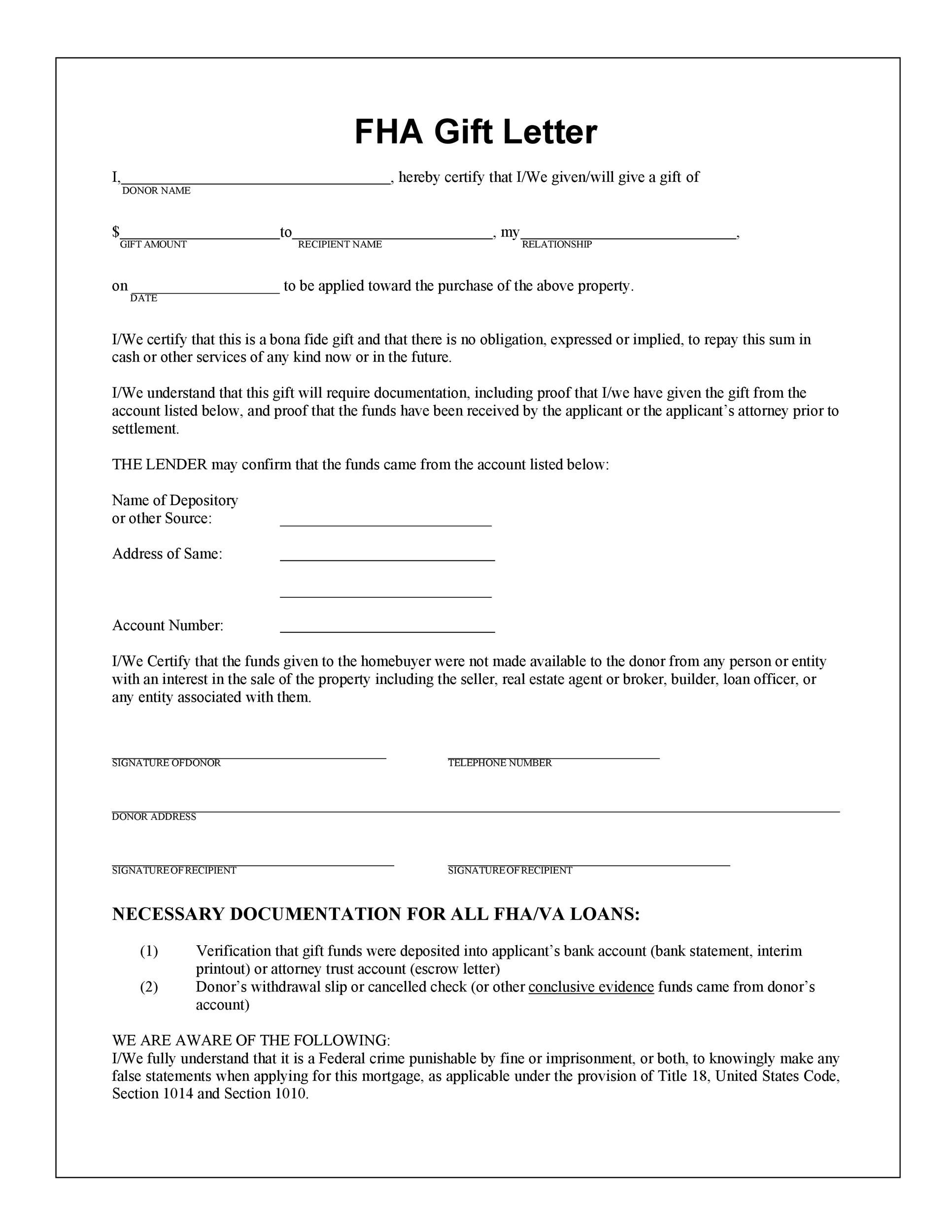

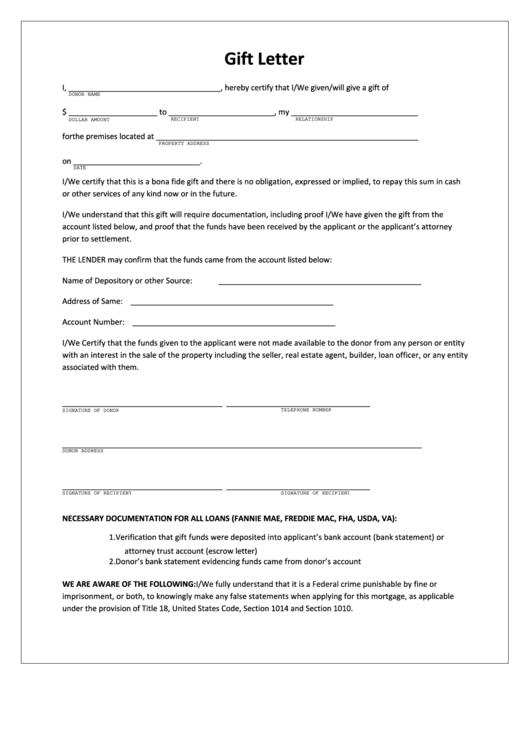

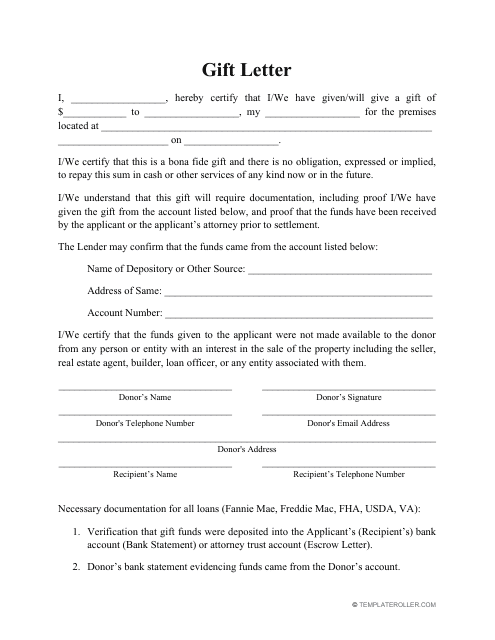

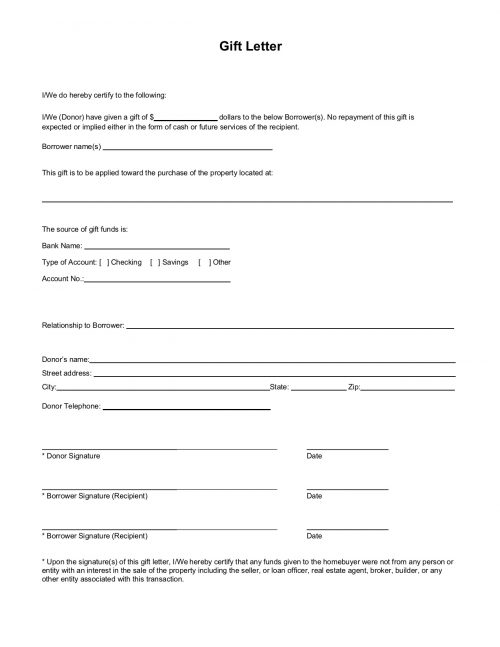

'Fannie Mae,Mortgage Guidelines,Gift Funds' Fannie Mae Guidelines Change Monday Apply Today To Lock In To "Old" Rules Fannie Mae rolls out new mortgage guidelines Monday Therefore, if you're in the process of applying for a conforming home loan, consider giving your complete application by the close of business Friday All Fannie MaeNECESSARY DOCUMENTATION FOR ALL LOANS (FANNIE MAE, FREDDIE MAC, FHA, USDA, VA) 1 Verification that gift funds were deposited into applicant's bank account (bank statement) or attorney trust account (escrow letter) 2 Donor's bank statement evidencing funds came from donor's accountOwn funds required Evaluated by DU 1 Unit ARM 75% 75% Purchase 24 Units Fixed 2 Unit $533,850 3 Unit $645,300 4 Unit $801,950 75% 75% Subject to DU Approve/Eligible min score 6* DU Approved Eligible 100% of borrowers own funds required Evaluated by DU 24 Units ARM 65% 65% Limited Refinance 14 Units Fixed

How To Use Gift Money For A Down Payment On A Home

The Capital Note Fannie Mae Freddie Mac And John Mcafee National Review

Gift Funds A borrower of a mortgage loan secured by a principal residence or second home may use funds received as a personal gift from an acceptable donor Gift funds may fund all or part of the down payment, closing costs, or financial reserves subject to the minimum borrower contribution requirements below Gifts are not allowed on an investment property We're here to help During this uncertain time, you can continue to turn to Fannie Mae as a source for reliable mortgage and housing information Learn how refinancing could help reduce monthly mortgage payments Find tools and resources to help demystify the homebuying process'Fannie Mae,Mortgage Guidelines,Gift Funds' Fannie Mae Guidelines Change Monday Apply Today To Lock In To "Old" Rules Fannie Mae rolls out new mortgage guidelines Monday Therefore, if you're in the process of applying for a conforming home loan, consider giving your complete application by the close of business Friday All Fannie Mae

What Is A Gift Letter For A Mortgage The Truth About Mortgage

Www Usadirectfunding Com S 18 Usa Fnma Homeready Quick Reference Matrix Pdf

The entry of gifts and grants on the loan application is as follows Form 1003 7/05 (rev 6/09) When a gift is entered in Section VI Assets as a gift, the funds are included in available funds It is important that the gift amount is identified separately as a gift even if the funds have already been deposited in a liquid asset account owned by the borrower (such as a checking orAnswer See highlighted text below from FNMA selling guide You will notice that there is NO requirement to provide bank statements from the A subscription is required to access thisThe insurer meets Fannie Mae's rating requirements as specified in 301, Property Insurance Requirements for Insurers A Policy Declaration page is acceptable evidence of flood insurance Note A mortgagee clause is not required for a Residential Condominium Building Association Policy or an equivalent private flood insurance master policy For additional information on mortgagee

Take Advantage Of Low Down Payments With Fannie Mae Downpayment Affordabledownpayment Homebuyer Buyer Househunting Mortgage Loans Fannie Mae Alvarado

1

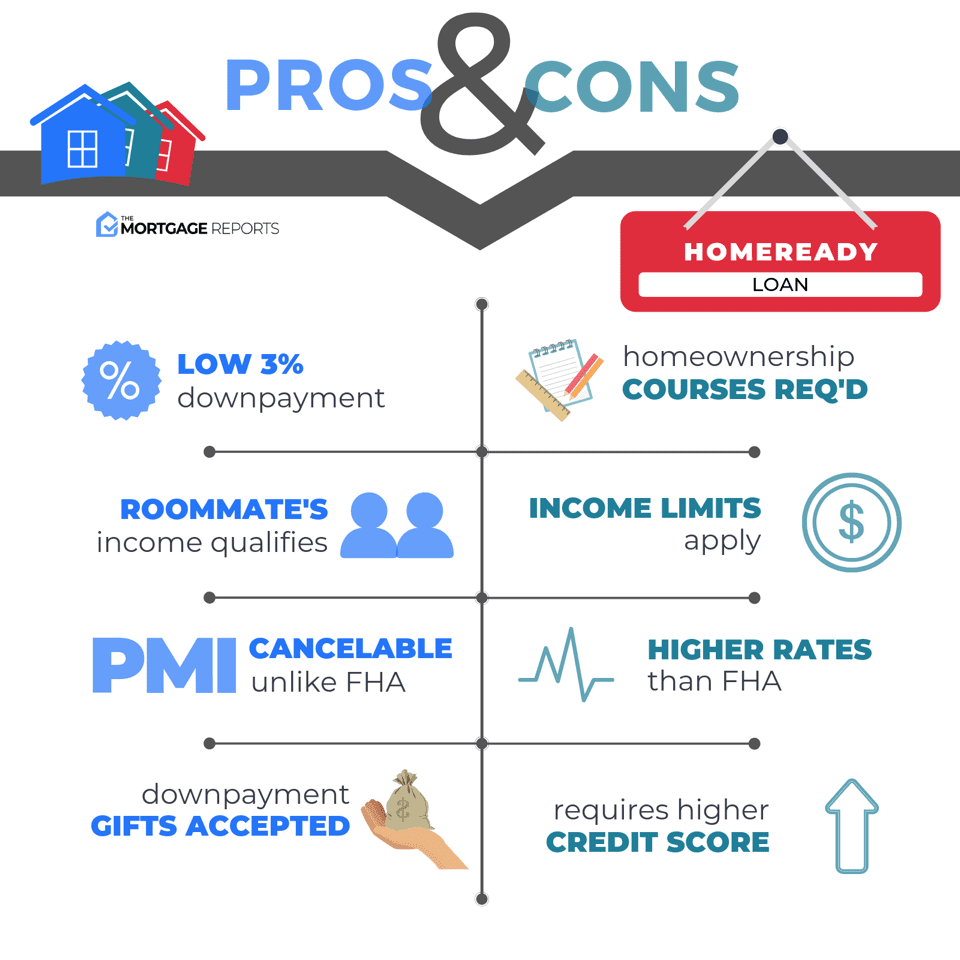

Gift funds are allowed for the down payment of 3 percent or 5 percent and have kept consumers out of the debttoincome ratio, which compares all monthly minimum payments to your mortgage requirements to refinance A new opportunity for home ownership is available to moderateincome borrowers through Fannie Mae's new HomeReady mortgage Fannie Mae details regarding borrowers receiving help with closing costs An acceptable donor may provide personal gift funds to a borrower of a mortgage loan secured by a principal residence or second home Gift funds can be all or part of the down payment, closing costs, or financial reserves subject to the minimum borrower contribution requirements belowLower MI coverage (25% for LTVs >90% to 97%) compared with standard requirements • ®Gifts, grants, Community Seconds , and cashonhand permitted as a source of funds for down payment and closing costs

Fannie Mae 97 Conventional Mortgage Loan Is Back Prmi Delaware

What Is Fannie Mae Us News

Fannie Mae rolls out new mortgage guidelines Monday Therefore, if you're in the process of applying for a conforming home loan, consider giving your complete application by the close of business Friday All Fannie Mae applications taken on, The FHA singlefamily home loan rule book, HUD , has detailed instructions for the lender where gift funds are concerned Gifts are traditionally used for home loan expenses including down payments, but when the borrower accepts gift funds for the purpose of making that down payment, the funds must meet FHA acceptability standards Fannie Mae Down Payment Guidelines now offer 3% down payment on conventional loans for first time home buyers Those who are not first time home buyers need a 5% down payment on a conventional loan home purchase Fannie Mae used to require that a home buyer needed to have 5% of their own funds when getting a gift for the down payment on a high

Fannie Mae Vs Freddie Mac Primacy Real Estate

A minimum borrower contribution from the borrower's own funds is not required All funds needed to complete the transaction can come from employer assistance Two to fourunit principal residence The borrower must make a 5% minimum borrower contribution from his or her own funds After the minimum borrower contribution has been met, employer assistance can beSubpart A3, Getting Started With Fannie Mae 99 Chapter A31, Fannie Mae's Technology Products 100• a signed gift letter (see 4304, Personal Gifts ()), and • the settlement statement listing the gift of equity Gifts of Equity and Interested Party Contributions If the requirements listed in this topic are met, the gift of equity is not subject to Fannie Mae's interested party contribution

Amazon Com The Mortgage Wars Inside Fannie Mae Big Money Politics And The Collapse Of The American Dream Howard Timothy Books

Www Findmywayhome Com Wp Content Uploads 17 08 Fnma Gift Funds Pdf

When a gift of equity is provided by an acceptable donor, the donor is not considered to be an interested party and the gift of equity is not subject to Fannie Mae's interested party contribution requirements (see 4102, Interested Party Contributions (IPCs))Fannie mae gift funds guidelines 19 Fannie Mae (FNMA) has recently generated enthusiasm by changing its down payment guidelines and allowing gift funds to be an acceptable form of down payment instead of a borrower's equity Before we all get used to the idea that FNMA gets a little FHA in it with respect to gift funds, we need to realize that the guidelines for mortgage

Letter Gift Fill Online Printable Fillable Blank Pdffiller

New Content Mortgageinsurance Genworth Com Documents Training Course Acceptableusegiftfunds Presentation 10 Pdf

Fannie Mae Homeready 21 Guidelines And Income Limits

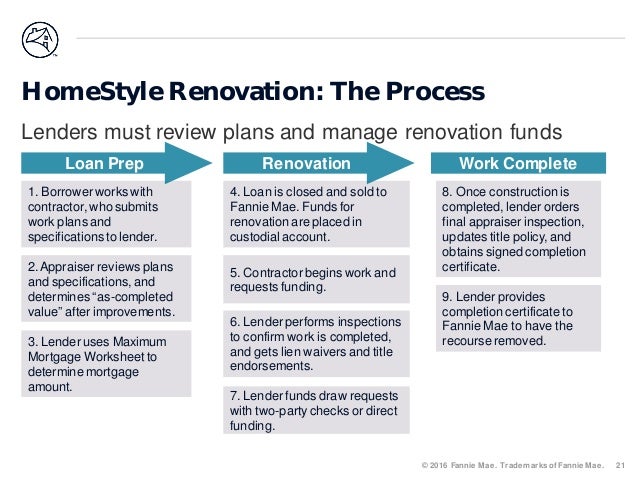

Power Point Presentation Fannie Mae S Home Path

Amazon Com Mortgage Meltdown Mapping The Past Present And Future Of Fannie Mae Ebook Mukherjee Ishwar Kindle Store

Pin On First Time Homebuyer Inspiration Info

Guaranteed To Fail Fannie Mae Freddie Mac And The Debacle Of Mortgage Finance Acharya Viral V Richardson Matthew Van Nieuwerburgh Stijn White Lawrence J Amazon Com Books

Document

Paper Trail Archives Dpa Search

Down Payment Gift Rules From A Friend Or Relative

Www Plazahomemortgage Com Downloadfile Aspx Filepath 5cdocuments 5cplazaprograms 5cfannie Mae High Balance Arm Program Summary Gd Pgco 014 Pdf Filename Fannie Mae High Balance Arm Program Summary Gd Pgco 014 Pdf

Fannie Mae Vs Freddie Mac Primacy Real Estate

Fannie Mae And Freddie Mac Guidelines For Conventional Loans

Fannie Mae Gift Letter Fill Online Printable Fillable Blank Pdffiller

Fnma Gift Funds Refresher Cute766

Fannie Mae Gift Letter Pdf Fill Online Printable Fillable Blank Pdffiller

Managing Fha Loans In Point Correctly Processing Fha

Did U S Steal 300 Billion From Investors In Coercive Takeover Of Fannie Mae Freddie Mac

Here Is The New Buzz In Jax This Can Be A Game Changer For Increasing Sales In St Johns County See Info On A Special Fanni Mortgage Info Fannie Mae Mortgage

Fannie Mae Homepath Loan Program Discountinued October 6 14 Prmi Delaware

Why Fannie And Freddie Are Not To Blame For The Crisis By Jeff Madrick The New York Review Of Books

Fannie Mae Requirements For Investor And Second Home Borrowers With Five To Ten Financed Properties Iloan Home Mortgage

Fannie Mae Loans Smartasset

Creditworthy Buyers Get Extra Flexibility From Fannie Mae The Washington Post

New Content Mortgageinsurance Genworth Com Documents Training Course Avoidingcommonuwerrors Presentation 0919 Pdf

Gift Fund Guidelines For Conventional Loans

100 Gift Funds As The Down Payment For Your New Home

New Content Mortgageinsurance Genworth Com Documents Training Course Du Advancedguidelines Presentation 02 Pdf

35 Best Gift Letter Templates Word Pdf ᐅ Templatelab

Desktop Underwriter Training Webinar Slides

Document

Financing Residential Real Estate Lesson 10 Conventional Financing Ppt Download

Fannie Mae Updates Libor Arms And Gift Fund Policies Cute766

Gift Money For Down Payment And Gift Letter Form Download

Fannie Mae Guideline Changes Gifts 97 Financing And Mortgage Insurance Iloan Home Mortgage

Fannie Mae And Freddie Mac Down 40 Superstonk

1

Fillable Gift Letter Template Printable Pdf Download

2

Fannie Mae Afrwholesale Com

35 Best Gift Letter Templates Word Pdf ᐅ Templatelab

Fannie And Freddie Face Price Competition From Mortgage Investors Orange County Register

Fannie Mae Vs Freddie Mac The Difference Rocket Mortgage

Homeready Mortgage Fannie Mae

Freddie Mac S Home Possible Versus Fannie Mae S Homeready Which Is Better Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Du Job Aid Entering The Data For An Fha Loan

Fannie Mae Updates Libor Arms And Gift Fund Policies

Five Most Frequent Questions About Gift Funds Blueprint

Fannie Mae Gift Letter Pdf Fill Online Printable Fillable Blank Pdffiller

Gift Letter Template Download Fillable Pdf Templateroller

New Content Mortgageinsurance Genworth Com Documents Training Course Du Advancedguidelines Presentation 0819 Pdf

Fannie Mae Goes All Out On Fintech Collaborations

Conventional Loans Fannie Mae And Freddie Mac Realty 101 Blog

1

Homeready By Fannie May The Borrowers Home Financing Fannie Mae

Saudi Arabia S Fannie Mae Eyes Debut International Bond In 21 Arabianbusiness

Fannie Mae Investment Property Down Payment Alternative Options

Letter Gift Fill Online Printable Fillable Blank Pdffiller

/rules-for-documenting-mortgage-down-payment-gifts-4157907-FINAL-9c59d5c0b3e445e1a142b323f35176e1.png)

How To Document Mortgage Down Payment Gifts

New Content Mortgageinsurance Genworth Com Documents Training Course Avoidingcommonuwerrors Presentation 0919 Pdf

About Cash Down Payment Gifts For Home Buyers

Fannie Mae Gift Funds Using Gifted Funds Toward Your Home Purchase

2

Fannie Mae And Freddie Mac Guidelines For Conventional Loans

Fannie Mae Home Ready Overview Naihbr

Home Ready By Fannie Mae

Homeready Mortgage Low Down Payment Zillow

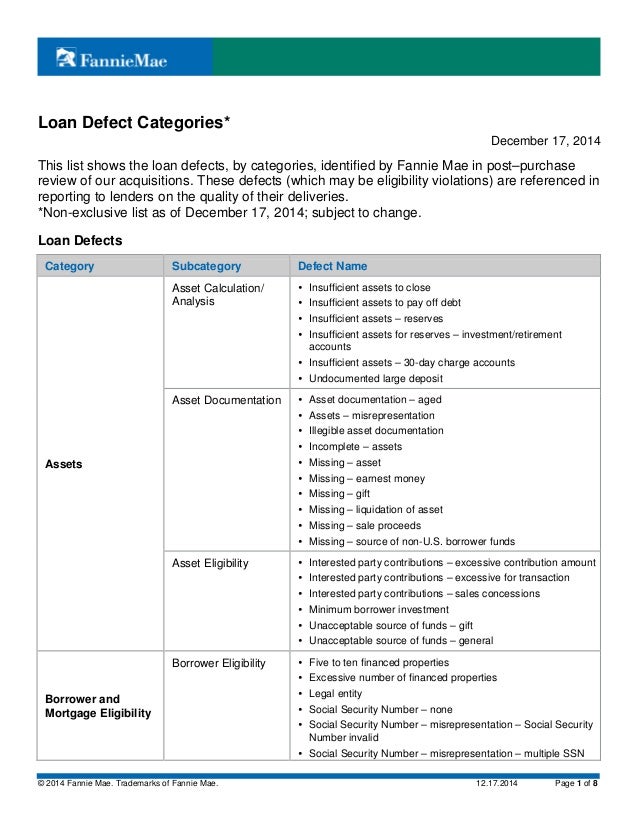

Fannie Mae Loan Defect Categories 12 17 14

Groups Say Fannie And Freddie Are Gouging Home Buyers With Add On Fees The Washington Post

Southern California Mortgage Brokers Suspected In Fraudulent Loan Applications Orange County Register

After Dithering Ten Years Fhfa Fannie Mae And Freddie Mac Final Dts

Your Guide To Using Gift Funds For A Down Payment

New Content Mortgageinsurance Genworth Com Documents Training Course Du Advancedguidelines Presentation 0819 Pdf

Fannie Mae Now Allowing Lenders To Contribute To Borrower Closing Costs Housingwire

Fillable Online Fannie Mae Gift Funds Letter Sample Mybooklibrarycom Fax Email Print Pdffiller

コメント

コメントを投稿